|

Written By: Candy M. Davis, CPA, CGA This article is an amendment to one released in 2018, as more information, rulings, and interpretations have subsequently been released by Canada Revenue Agency. I personally became involved in the mining of Bitcoins and other altcoins around 2012. I have used these digital currencies both as a form of investment and to purchase goods/services. In addition, I have traded cryptocurrencies through online brokerages since 2013 when they began to rise in popularity. At the beginning of 2018, I submitted a technical interpretation request to CRA looking for more specific guidance for the treatment of cryptocurrencies. In June, I received a short reply pointing to two documents previously released in 2013 and 2014. Following the written reply, I had a telephone meeting with the Canada Revenue Agency to discuss the matter further. It was in this meeting that I was able to confirm their opinions and requirements for tax reporting of certain cryptocurrency transactions. Some of these opinions from CRA have changed slightly over the years, such as the treatment of mined virtual currencies for tax purposes, but generally the original guidance has been consistent (and sparse!) since our discussions in 2018. As we have experienced a few years of general uncertainty as tax practitioners, I'm happy to share some guidance based on the information I have received from the Canada Revenue Agency and other related sources. Note that this updated article is written December 15, 2021- given how quickly technology and the use of digital currencies has been evolving, there is a good chance that new rules or legislation will be introduced shortly. Therefore, this guidance may not necessarily be applicable at a future date. The tax treatment of digital currencies differs depending both on how they are acquired and how they are used. The two main ways to acquire digital currencies are by purchasing them or by mining them using specialized computer software. We will not go into the specifics of how mining works in this article but if you would like more information there's a fantastic interview you can refer to with Michael Maier PhD, CPA, CGA and Joseph Devaney CPA, CA of Video Tax News. Once these coins are acquired they can be used in multiple ways- most commonly as a form of investment or to buy goods and services. In this article, I will focus on the tax treatment of these different uses as well provide references to certain documents which you may find helpful as you encounter these situations in the future. Note that the discussion to follow makes the assumption that transactions occur between arm’s length parties and reflect fair market value. The use of the terms “virtual currency” and “digital currency” can be considered interchangeable for the purposes of this article. Acquisition of Digital CurrenciesAccording to the Canada Revenue Agency, they consider cryptocurrencies to be a commodity, not a currency, for the purpose of the Income Tax Act. As such, their acquisition and use will follow the guidance set for Barter Transactions which involves the trade of one good or service for another good or service. Direct purchase A purchase of digital currencies for cash is the most straightforward type of transaction for tax purposes. Assuming the coins are purchased from an arm's length third party, it is likely that the amount paid for the virtual currency will reflect the fair market value of the coin at that time- thus the cost/adjusted cost base will be the amount of consideration paid. Received as a form of payment for goods or services provided Digital currencies are sometimes used to buy goods or services and these activities follow the rules for barter transactions. When a coin is exchanged for a good or service in an arm's length transaction, it is assumed that the fair market value of the coin exchanged will be equivalent to the fair market value of the good or service received. If the coin does not have a published or easily attained market value, then CRA has indicated that the department will normally accept the value to be equivalent to cost of the good or service that was provided in exchange. Received as a Gift The receipt of digital currencies as a gift, like other tangible gifts, will have an adjusted cost base of nil since no consideration is given up acquiring the currency. However, their fair market value should be reflective of the fair market value at the time of transfer. This is the value that will be used to determine the eligible amount of a gift for tax purposes as well if donations of coins, such as Bitcoins, are given to a qualified donee. See 2013-0514701I7 for further clarification by CRA on this topic. Received through Mining The CRA has recently released the most comprehensive guidance to date on the treatment of cryptocurrencies. It is especially appreciated to finally have some concrete information regarding the taxation of mined virtual currencies. You can access the guide here (updated to June 26, 2021 as of the date of this article). Mining, the use of specialized mining software to discover coins such as Bitcoins, is done by individuals (privately or as part of a larger mining pool) as well as on larger commercial scales. As the difficulty in mining Bitcoins has increased over the years, it is more and more common to see them mined in a commercial manner. Individuals, more often than not, are now mining other easier-to-attain coins. Unofficially, at one point, CRA had indicated that the cost of mined coins would be deemed to be nil for tax purposes arguing that there were no real direct costs that would be linked to the creation or receipt of mined coins and no consideration has been given up for them. We have finally received a slight update in position by CRA, and guidance on the tax treatment of these mined coins. This has been the only real change to the guidance provided since 2013/2014. Further clarification can be found in T.I 2018-077666 which states, “Generally, when a miner successfully creates a valid block, they will receive two types of payments. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Those who perform the mining processes are paid in the cryptocurrency that they are validating. In our view, Bitcoin received by a miner to validate transactions is consideration for services rendered by the miner. Where a taxpayer is in the business of Bitcoin mining, the Bitcoin received must be included in the taxpayer’s income at the time it is earned under section 3 and section 9 of the Income Tax Act.” In summary, the fair market value of the digital/virtual currency received from mining would be reported in income in the tax year it is received. This value would also become the cost or adjusted cost base for the calculation of future income or gains, to be discussed shortly. Use of Digital Currencies and Related Tax TreatmentsBuying Goods and Services CRA has indicated in IT-490 that "the value of these goods or services must be brought into the taxpayer's income where they are the kind generally provided by him in the course of earning income from, or related to, a business or profession carried on by him." Note that when cryptocurrencies are received as a form of payment, GST registrants will be required to calculate and remit the GST on the fair market value of the service or good sold. On the other end, ITC’s may also be claimed by registrants for the GST deemed paid by cryptocurrencies. See the discussion in 2013-0514701I7 for more information. Trading one Digital Currency for Another One of the more common issues now encountered by tax practitioners, is the common use of brokerages that enable online trading of several digital currencies. Often these coins can be bought and sold for other coins without being ever exchanged for cash. Unbeknownst to many avid traders, each time a coin is traded for another, there is a deemed disposition of the original coin- triggering a taxable event. This is true even if the coins are never converted to cash in the year or never leave the brokerage account. Even if the coins are similar in nature, they will be considered different individual properties. CRA has provided DOC 9515925, which deals with the exchange and partition of land, as a reference. In this letter, CRA states that “the exchange of one parcel for another would be considered a barter transaction which would give rise to a disposition and a possible capital gain”. Similarly, the exchange of one coin for another will also give rise to a disposition and a gain or loss. Investments After speaking with several tax practitioners, I’ve noticed that there have been some differing ideas of how CRA may choose to assess the sale of investments in cryptocurrencies (capital gain or regular income) in light of their previous statements that these are to be treated as commodities not currencies. Given the opposing definitions and tax treatments of commodities vs. capital properties in the Income Tax Act, this has caused some unease for accountants in tax planning and advising clients. In my 2018 telephone meeting with CRA, they confirmed that their assessments of whether or not investment and trading of digital currencies will be considered taxable of account of capital or on account of income will be based largely on paragraphs 9 through 13 of IT479R “Transactions in Securities”. which they have since confirmed in subsequent publishings. As such, the same consideration will be given for the trading of cryptocurrencies as for the assessment of other common securities- ie. Is an individual investing on a personal level (capital) or in a commercial manner (income). Short-term personal investments/Day Trading: If the buying and selling of the digital coins meets the criteria for business transactions set out in IT479R, it will be fully taxable on account of income. Some of the criteria that are often considered for this classification include the frequency of trades, the knowledge and expertise of the individual regarding those activities and underlying securities, period of ownership. Long-term investments: Assuming these long-term investments are considered personal in nature then the subsequent sale will be on account of capital. In summary, digital currencies will be considered commodities for the purposes of buying and selling goods (barter transactions), however they may be treated like securities for the purpose of buying and selling them as investments. Further direction can be found in document 2013 -0514701I7. Sale of Mined Digital Currencies For tax purposes, the treatment will be different depending on whether the individual is considered to be mining the coins personally as a "hobby" or in a commercial manner. In the T.I. 2014-052519, CRA provided some guidance in determining whether or not these mining activities would be considered a personal or business endeavor- pointing to Stuart versus the Queen, 2002 SCC 46, in which, " the Supreme Court of Canada stated that 'in order for an activity to be classified as commercial in nature, the taxpayer must have the subjective intention to profit and there must be evidence of business like behavior which supports that intention”. Personal activities, conversely, are those that are undertaken not for profit, but for pleasure and entertainment. As is often the case, there will be many circumstance-specific facts to consider when assessing if activities are undertaken as a business or not. It is the opinion of this author that mining would rarely be considered a “hobby” are and likely, in most situations, taxable undertakings. When a coin that has been mined is later sold on account of capital (capital gain), the ability to deduct mining costs is lost. However, costs incurred to sell the coins, such as brokerage fees, would likely be deductible. Conversely, if the mining process is considered done commercially, any profit will be fully taxable on account of income. In this case there will be several costs that can be expensed against the income earned from sale of the digital currencies (otherwise unavailable in the case of non-business-related mining). These will include cost such as warehouse rental space, amortization for computer hardware and software and related equipment, utilities, and other business expenses. Note that the digital currencies will be held as inventory and must be valued in accordance with the standards set out in interpretation bulletin IT-473R "Inventory Valuation". This bulletin specifies that this inventory may be valued at the lower of cost or fair market value at the end of the year, or at its fair market value at the end of the year. These regulations are set out in section 10 of the ITA and part XVIII of the Income Tax Regulations. Cryptocurrencies are fast gaining popularity and acceptance around the world and are more than likely going to change our financial landscape. And while Canada’s tax laws have been slow to issue concrete guidance on the subject, there is enough precedence and relatable tax laws in effect to begin to help steer our clients in the right direction. While some of our firms may deal with more complex cryptocurrency scenarios, this is a great start for tax accountants, lawyers, and their clients to gain a general understanding of the rules as they currently sit. With any luck, we will have better direction from Finance and CRA in the near future. Other Considerations...Foreign Income Reporting?

Consider where you or your clients are earning their income and holding their cryptocurrencies. Are they purchased and held in brokerages in other countries? You may need to file the T1135 Foreign Income Verification Statement Written By: Candy M. Davis, CPA, CGA A few short words.... Every year, as we approach another tax season, I get similar questions from people with home-based or direct marketing related businesses regarding what write-offs are available to them. I thought it might be helpful to provide some short summaries on some of the expenses you may be able to claim and, more importantly, what the rules and regulations are surrounding the eligibility of some of those deductions. Before we jump into it, I would like to mention a couple key things you should keep in mind as you go through these expenses and assess your own situation…

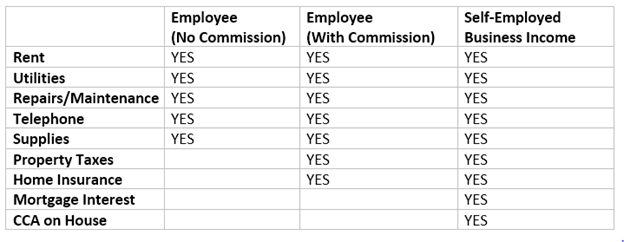

While these blogs will provide general information, they should not be used as accounting advice related to your specific situation as they are limited by circumstances, jurisdictions, and the time in which they are written. Now that that is out of the way, please sit back and enjoy the following articles! I hope you find them a helpful guide as you prepare for the upcoming tax season. What Kind of Income are You Earning?If you are working in direct sales or marketing for another company, chances are you will be receiving a tax slip of some kind at the end of the year. This will be one of the most important indicators for determining what type of income you are earning and consequently, what deductions are available to you when you prepare your personal tax return in the spring. T4: If you receive a T4 you are considered an employee. Pay attention to what boxes are filled out on your tax slip. If all of your income is recorded in box 14, you are receiving income as a regular employee. If all, or part of your income is also recorded in box 42- you are receiving commission income. This is an important distinction as commission salespeople may have additional expenses available to them to deduct from their employment income due to the nature of their jobs. T4A- If you receive a T4A with box 20 completed- you are receiving Self Employment Income. This means you are considered by the marketing company to be operating as a contractor (a sole proprietor). Individuals that are self-employed will have greatest number of potential expenses available to be deducted on their tax returns however, there may also be GST/HST implications as well. If you fall into this category, make sure to discuss with your accountant any additional responsibilities you may have. T2200- Declaration of Conditions of Employment If you are wishing to deduct any expenses as an employee, your employer MUST complete this form every year to confirm that, as part of your employment contract, you are required to pay personally for certain expenses directly related to performing your job. If your employer does not provide you with this form CRA will disallow your employment expenses. Note that this form states that you are required to pay for certain expenses but this does not automatically mean those expenses are deductible on your tax return. The deductions available to you must fall within the allowed expenses in the income tax act and often, are based on specific criteria which must be assessed on an individual basis. You can get a copy of this form directly from the Canada Revenue Agency website here What Expenses Can You Deduct?Unlike self-employed individuals, employees are quite restricted in the type of expenses they can deduct from their employment income. Your accountant will be able to help you determine what expenses may be available to you based on your individual situation. Home Office Expenses

If you are Self Employed, in order to be eligible to deduct any home office expenses you must meet the following criteria:

If you are an employee, in order to be eligible to deduct any home office expenses you must meet the following criteria:

*more info here* Home-based businesses will usually meet the first criteria to deduct the home office expenses. Contractors that provide services outside of their home may find they are unable to deduct home office expenses, even if they do their bookkeeping at home, due to not meeting these criteria. Meals & Entertainment You may be eligible to deduct “Meal and Entertainment” expenses if they have been incurred to earn income, or with a reasonable expectation of earning income. If so, 50% of your meal costs may be an eligible business deduction. The “50% rule” is set out in Section 67.1 of the Income Tax Act and is meant to account for the fact that meals and entertainment are usually, at least in part, personal due to the implied enjoyment derived from it. Note that there are some “entertainment” expenses, such as golf dues, that are not deductible at all! Make sure to seek advice from a tax professional if you’re unsure about the deductibility of any of these of expenses. And don’t forget to save your transaction receipts and write the name of your client(s) on the back, in order to provide a clear paper-tail should receipts ever be requested by CRA. *more info here* Automobile Expenses Everyone wants to write off fuel and automobile expenses! However, this is a very common area of audit by CRA because a lot of people claim these expenses improperly. So, let’s take a closer look at what your responsibilities are for properly deducting these expenses. You are most likely using your personal vehicle for some trips related to earning business income. Some of these might include trips to see clients, deliver products, attend meetings, purchase supplies, etc. So how can you deduct amounts spent on gas and vehicle maintenance that should be attributed to these extra trips? Firstly, and most importantly, you will need to maintain a mileage log. This log should indicate your starting and ending kilometers for the year, and well as details of every trip for business (Date of travel, starting point, destination, reason for trip, number of kilometers driven). It’s easiest if you just keep a notepad in your glovebox or download a mileage tracking app. If you’d like to print one out from the website, you are welcome to do so here: http://davisaccounting.ca/forms.html Secondly, you should keep all of your receipts related to fuel, insurance, maintenance and repairs, license and registration fees, lease payments, and interest. At the end of the year, your accountant will prorate the amount of your total expenses that is attributable to business travel based on the percentage of km driven for business use. Finally, it’s important to know what is, and isn’t, considered valid business travel. For example, CRA considers travel between your home and office (or place of work) to be personal in nature and not valid as business mileage. This is a surprise to a lot of people as most of the kilometers they would like to write off are directly related to this type of travel. Why isn’t is deductible? Well, EVERYBODY has to get to work. As such, it would be unfair to give a tax advantage to certain employees or self-employed individuals over other individuals. With that in mind, CRA has determined this is not valid business travel. (This is less of an issue for a home based business since there is no travel between home and work). For employees, in addition to having an employer provided T2200 and retaining a mileage log, additional criteria must be met: Paragraph 8(1)(h.1) of the Income Tax Act provides for the deduction by an employee of motor vehicle expenses where the employee – was ordinarily required to carry out the duties of employment away from the employer's place of business or in different places, – was required under the contract of employment to pay motor vehicle expenses incurred in the performance of the employment duties, – was not in receipt of an allowance in respect of motor vehicle expenses which was, by reason of paragraph 6(b), not required to be included in the taxpayer's income, and – did not claim a deduction for the year for travelling expenses under paragraph 8(1)(f) of the Act. As I mentioned previously, this area is quite complex. There are a considerable number of rules to determine what type of travel is deductible. If you aren’t sure feel free to ask your accountant or contact Canada Revenue Agency for further clarification. Travel Expenses These expenses include fees for accommodations, airline or rail tickets, taxi fares, and meals while travelling for business purposes. In order to be eligible to deduct these from employment income you must meet the following requirements:

To deduct the meals as part of a travel expense there is an additional stipulation that you must have been away from the metropolitan area of the employer’s business for at least 12 hours. If you meet this requirement you will be eligible to deduct 50% of the meals (the non deductible portion stems from the fact that meals are considered to be partially personal in nature- you had to eat anyways!). *More info here * Advertising & Promotion These expenses may include corporate pens, hats, or shirts. Other items may include signage, posters, business cards, and advertising fees. Advertising and promotional expenses tend to be 100% deductible, with some minor exceptions. Some of these exceptions include gift cards for clients, wine/alcohol gifts, and, as we’ve mentioned previously, meals! These will be deductible at the 50% rate. This is not an exhaustive list- just some of the more common expenses in the direct sales and marketing home based business scenarios. I will tackle some of these potential deductions in greater detail over the next couple of months, as the rules surrounding their deductibility can be quite complex. Written By: Candy M. Davis, CPA, CGA Over the past few years, Alberta energy and construction sectors have seen a sharp increase in the number of incorporated contractors. The benefits of incorporating provide incentive to many hard working individuals- but what are the risks? This article will review the reasons individuals incorporate, the risks, and how you can reduce your chances of being offside when it comes to filing your taxes.

Benefits to Hiring Incorporated Contractors vs. Employees Large companies in the energy and construction industries have been steadily replacing employees with incorporated contractors in an effort to reduce costs. The savings come in many forms such as the elimination of CPP and EI employer contributions, WCB and other insurances, health benefits, and retirement and severance packages. For these companies, the cost savings from reducing their workforce is enormous. It also allows more freedom for these companies to hire contractors as needed, eliminating the time, money, and paperwork that goes with the hiring, supervising, and laying off of employees. In industries that are tied so closely to the market, there is a lot of flux in the employment needs of these companies and hiring contractors is a much simpler way to have “as-needed” labour. For the individuals, incorporating a one-person company often seems attractive due to the perceived increase in freedom, additional eligible expenses that are not usually available to an employee, and the lower tax rate applied to small businesses in Canada (Canadian Controlled Private Corporations). In addition, in many cases companies will offer a premium to incorporated contractors as an additional incentive, paying them a higher wage than their employed counterparts. “Personal Services Business”- What is it? Section 125(7) of the Income Tax Act describes it as follows: “personal services business carried on by a corporation in a taxation year means a business of providing services where (a) an individual who performs services on behalf of the corporation (in this definition and paragraph 18(1)(p) referred to as an "incorporated employee"), or (b) any person related to the incorporated employee is a specified shareholder of the corporation and the incorporated employee would reasonably be regarded as an officer or employee of the person or partnership to whom or to which the services were provided but for the existence of the corporation, unless (c) the corporation employs in the business throughout the year more than five full-time employees, or (d) the amount paid or payable to the corporation in the year for the services is received or receivable by it from a corporation with which it was associated in the year;” In layman’s terms, it refers to a situation where an incorporated contractor would be considered an employee, given all relevant factors, if it wasn’t for the fact that they were operating through their corporation. Just because you have a “company” it does not automatically make you an independent contractor. For example, many employees choose to incorporate and then stay on with the same company- just switching from being on payroll to being a supplier of services. Other times, a newly formed corporation will seek out work but will work for a company in a context very similar to an employee. These situations are growing in popularity in Alberta and are increasingly the focus of scrutiny by the CRA. Personal Services Business- What does it mean to me, the contractor? Because the Income Tax Act considers PSBs to be essentially “incorporated employees” it seeks to equalize the tax treatments of both parties. As such, PSBs face certain restrictions not applied to other small businesses (CCPCs): 1) Limited Eligible Deductions- Instead of being able to deduct a wealth of expenses like other corporations, ITA 18(1)(p) restricts PSBs to the following deductions: (i) the salary, wages or other remuneration paid in the year to an incorporated employee of the corporation,(ii) the cost to the corporation of any benefit or allowance provided to an incorporated employee in the year, (iii) any amount expended by the corporation in connection with the selling of property or the negotiating of contracts by the corporation if the amount would have been deductible in computing the income of an incorporated employee for a taxation year from an office or employment if the amount had been expended by the incorporated employee under a contract of employment that required the employee to pay the amount, and (iv) any amount paid by the corporation in the year as or on account of legal expenses incurred by it in collecting amounts owing to it on account of services rendered The rationale is that the incorporated contractor or incorporated “employee” should not be able to receive an advantage over employed individuals in the same positions. It ensures everyone is taxed at a similar rate and receives equal treatment, no matter which path they choose. 2) Income earned by the PSB is deemed not to be Active Business Income. ABI is the regular income a corporation earns from selling goods and services, basically it’s income it has to work for. Unlike income from property and investments that face a higher corporate tax rate, active business income is treated to a small business deduction to the corporate rate. Federally, that means the tax rate is reduced from 28% to 10.5% in 2016 (this includes the general rate reduction and small business deduction). However, since Personal Services Businesses are considered not to have active business income, they are not eligible for these deductions. As such, they are subject to the full 28% federal corporate tax rate. As of January 1, 2016 income earned in a PSB faces an increased tax rate of 33%. This generally renders any previous tax advantage of operating through a corporate form obsolete. Factors in Determining Status as Independent Contractor or “Incorporated Employee” Recent court cases have created precedence which the CRA uses to help determine the status of a corporation on a case by case basis. Generally, four main factors are considered to help determine whether an individual should be considered an independent contractor or an employee (and thus a Personal Services Business). 1) Control- Does the payor or the contractor decide what and how the work will be done? Can the contractor refuse certain jobs? 2) Ownership of Tools- Does the payor or the contractor provide the tools used in the work? Has the contractor made a significant investment in tools and is responsible for their maintenance, repair, and insurance? 3) Chance of Profit and Risk of Loss- Will the contractor make a profit or loss, or is the contractor paid a wage in a structure similar to an employee? 4) Integration- Is the contractor essential for the operation of the payor’s business or an integral part of that business? The CRA also considers other factors such as whether or not the contractor may hire subcontractors or replacements to do the work in their stead. There is a pretty comprehensive discussion of situations that constitute one status or the other available on the CRA website at http://www.cra-arc.gc.ca/E/pub/tg/rc4110/rc4110-e.html#resp_invest_man. It is important to note that one or two of these factors alone does not put a contractor in one category or the other. Rather, it is the combination of facts from all the considerations listed above that both the CRA and the courts review to determine the status of a contractor. Though agreements and written contracts may help to show the intentions of the parties, the courts have recently rules that intention does not override fact. Secondary factors may also affect the determination and will be considered on an individual basis. Risks to Incorporated Contractors The main risk to contractors filing as a regular CCPC with active business income is the reassessment of corporate tax filings by Canada Revenue Agency. If it is determined that the business is in fact a PSB the reassessment will result in taxes owing due to the claiming of ineligible expenses and a reduced tax rate not available to Personal Services Businesses. For most contractors, this would be a financial hit they could not afford. I’m an Incorporated Contractor- Now What? If you currently provide services in a corporate structure, similar to that described in this article, you may be feeling a little nervous. This is a shock to a lot of contractors who weren’t aware of the distinction when they decided to incorporate. While the desire to save money and taxes is a common goal, the priority should be to do so within the parameters set out in the Income Tax Act. If you are concerned that you fall within this gray area, or are pretty certain you would be considered a PSB, I would encourage you to speak with your tax accountant to help determine the correct status of your corporation. The CRA does provide some good reading material to help you decide if you would be considered an independent contractor or an employee, which you will find links to below this article. You can also request a ruling by CRA here: http://www.cra-arc.gc.ca/E/pbg/tf/cpt1/README.html Considering Incorporating? Take the time to talk to your professional tax accountant or tax lawyer about your intentions with the corporation. I think a lot of the time the reason people get caught off guard with this issue is because they incorporate on their own instead of through an accountant or lawyer and miss out on some really important information in the process. With the proper guidance, you may also be able to structure your business in a way that it will not be considered a PSB. Since many large companies in the industry have shifted focus to hiring contractors instead of employees, some individuals must incorporate to get the jobs they want. It may be unavoidable for you to be a Personal Services Business, but at least you will know ahead of time and not make the mistakes others often make by deducting expenses that will be deemed ineligible in a future audit. As long as you are doing it right off the start, you have nothing to worry about! Is It worth being a Personal Services Business? It really depends on your individual situation. Do you need to be incorporated in order to get the job you want? For most individuals, there is little incentive for tax deferral within a PSB given the high corporate tax rate, but other factors may still make it a beneficial structure for you. Don’t make this decision lightly, get the advice you need! -Candy M. Davis, CPA, CGA Davis Accounting & Tax Professional Corporation www.davisaccounting.ca Helpful Links: CRA “Employee or Self Employed?” http://www.cra-arc.gc.ca/E/pub/tg/rc4110/rc4110-e.html#resp_invest_man CRA “Canada Pension Plan and Employment Insurance Explained- Workers engaged in construction - Employees or self-employed workers?” http://www.cra-arc.gc.ca/tx/hm/xplnd/cnstrctn-eng.html Other great articles you may wish to check out: “Incorporated Contractors: how to avoid the Canada Revenue Agency’s nasty double-taxation classification” By Brandon Holden, Burnet, Duckworth & Palmer LLP “OLD NEWS, NEW TREND: PERSONAL SERVICES BUSINESSES ON THE RISE” by Sophie Virji, Associate with the Calgary office of Dentons Canada LLP “Canada: Are You Walking Into A Tax Disaster – Incorporated Contractors & Taxes (Part I)” by Kenneth Keung at Moodys Gartner Tax Law LLP Written By: Candy M. Davis, CPA, CGA There are numerous tax software programs out there, and to be honest, they’ve gotten pretty user friendly over the past few years. Canada Revenue Agency is even updating their sites to allow users with a MyAccount to use their Auto-Fill My Return feature to import important data like T-slips and carryover amounts! Doing your taxes at home couldn’t be any easier.

So what’s the problem? The problem isn’t in claiming your revenue. Most people have no problem inputting data from the T-slips into the software and calculating basic credits. But if you file that automatically prepared return there is a very good chance you’re still overpaying on taxes! Why? Lost Credits and Deductions There are a ton of credits and deductions out there that will reduce your overall tax burden. Some of them are even refundable which means they don’t only reduce your tax owing, but they will turn into a refund for you! The problem is that a lot of people have no idea that these credits and deductions exist. This is due, in part, to the fact that the software programs just can’t know everything about you. They can’t always ask all the right questions and can’t understand your individual situation. So you may be entitled to something which would reduce your taxes owing and you would just never know! It’s not your fault, and it’s not the tax software’s fault… it’s just the way it is. The other reason you probably don’t know about some of the things you’re eligible for is because a lot of things are complex, deeply embedded in the Income Tax Act, and based on several layers of stipulations. Do you have children? Are you a single parent? Are you in the trades? Are you married or common law? Do you have a disability? Do you have a dependent? Are you a student? Do you have your own business? ARE YOU A PERSON?! There are so many things you are eligible for, and chances are you’ve only heard of half of it! I want you to have it all!!! The Elusive RRSP Slip Throughout my years of tax practice, I’ve noticed one thing again and again! Your investment broker is probably terrible at sending you the RRSP slip for the first two months of the following year. A lot of people don’t even know that they should be getting one! RRSPs are claimed on your tax return in two parts. The first is from March through December of the applicable tax year. The other is for the first two months of the following year. It’s one of the only parts of your tax return that doesn’t follow proper calendar year rules, and no- you can’t just sneak those contributions into any other tax year’s return. So, if you’re missing and not filing part of your RRSP contributions in your tax return, you may be missing out on some great RRSP deductions! Claiming The Wrong Stuff The other big problem I see actually involves individuals claiming deductions and credits they are not entitled to. This happens for different reasons and most often it’s completely innocent! Sometimes the software used will suggest certain credits for you in error, because it does not properly understand your individual situation. Often people just include these credits assuming they are entitled simply because they are unaware of the eligibility requirements. Other times, the wording of certain parts of the income tax forms can be really backwards and confusing. For example, claiming “eligible dependents” doesn’t mean claiming all of your children (who are actually claimed on a different line of the tax return), however it could still mean your child, but only under strict circumstances. It could also not be your child at all. Confused yet? Other people claim the wrong stuff because they simply aren’t aware of the tax laws set out in the Income Tax Act. A lot of people think certain things should be tax deductible that simply aren’t allowed. Other people confuse deductions that a business could make with ones an individual can make (individuals are much more limited in their deductions than a business is). And finally, there are simply a lot of “myths” out there that people mistakenly accept as fact. As I mentioned, most often these are honest mistakes. However, these mistakes come at a hefty price once your return is audited by CRA. When deductions and credits are disallowed by CRA, individuals often find themselves owing more taxes and the added interest and penalties that go along with it! People often say things like, “Well I’ve been claiming it for years and CRA has never said anything” or “Well that’s what my friends do”. That doesn’t mean it’s allowed; it means that the individual’s return has never been audited. Believe me, you don’t want to be that person when they finally get selected for a review of their returns! My Point? You can’t always rely on the generic tax preparation software. These programs cannot account for every individual’s circumstance and there's no way they can tell if you're missing something! And I’m guessing you don’t spend all of your free time studying the Income Tax Act, reviewing the newly released budgets, and pouring over the CRA new releases and folios. As a Chartered Professional Accountant and a tax preparer, I’m biased. I WANT you to bring your taxes to me. I WANT your business. But I’d be just as happy to know you were seeing another professional accountant for your tax preparation and filing. Why? Because every year I meet more and more clients who have been leaving important parts of their tax returns blank and have paid way too much in taxes. You don’t have to “cheat the system” to pay less tax. You have to know the system. And that is what professional accountants do. They make sure you are claiming the right stuff and getting every credit and deduction you are entitled to! They help save people, like you, money. And who doesn’t want more money in their pocket? |

Candy m. DavisSharing knowledge, ideas, and tips! Archives

December 2021

Categories

All

|